INREV: paralysis looms due to unclear definitions and measurement methods of SFDR

INREV, the umbrella organization for unlisted real estate funds, is calling for more clarity from the European Union on definitions, measurement methods, and tailored rules for real estate investments aimed at sustainability. According to INREV, the current definitions of sustainable investments under SFDR are too vague, and compliance with proposed numerical criteria is difficult without further clarification. There is also a risk of misinterpretation of data and accusations of greenwashing.

The vagueness of current regulations could even lead to a brake on investments in real estate aimed at tackling issues such as climate change, as well as social issues around health and well-being, according to INREV's response to the consultation by the European Securities and Markets (ESMA) on guidelines for fund names using ESG or sustainability-related terms.

"RTS too vague and inaccurate"

On January 1, 2023, the Regulatory Technical Standards (RTS) came into effect with Level 2 requirements, known as SFDR Level 2. INREV points out that the EU Commission developed the SFDR regulatory framework for public financial markets, which represent approximately 90% of all investments and therefore form the main focus of regulation.

However, the real estate market, which represents only about 3% of total financial capital, is responsible for approximately 39% of total CO2 emissions and 36% of energy consumption. Real estate therefore has the potential to have a significant impact on accelerating the path to a more sustainable Europe. It is therefore crucial how the regulatory framework originally designed for public markets (which tend to have short-term trading horizons) relates to private markets, such as the real estate market, which are characterized by medium to long-term active management strategies.

According to INREV, the unlisted real estate investment industry has difficulty complying with SFDR and the taxonomy due to the vagueness and inaccuracy of the existing definitions and the limited nature of the current measurement methods described in Level 2 regulations related to real estate as an asset class.

When it comes to clear definitions and standards, the market itself has taken the lead in recent years with sector-specific guidelines and recommendations specifically targeting the assessment of the sustainability of real estate, with standards and benchmarks such as BREEAM, LEED, WELL, Fitwel, Wiredscore, GRESB, and others.

Paralyzing effect on impact-capital real estate

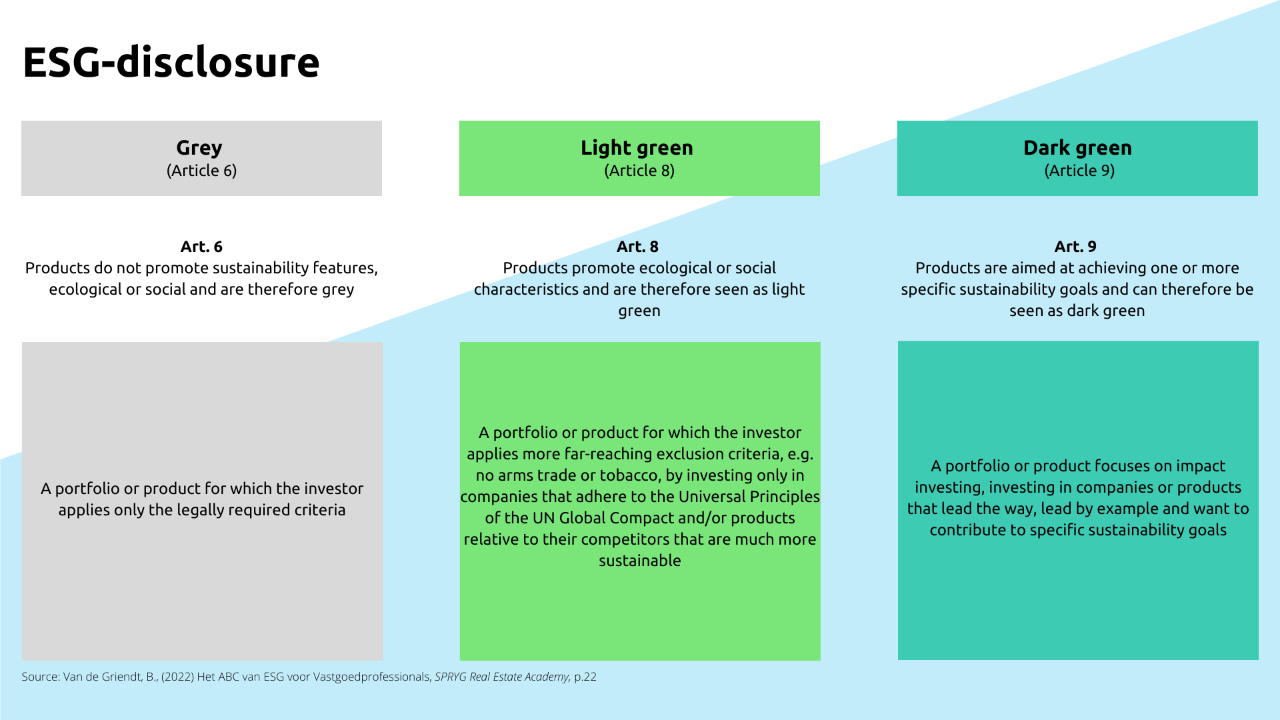

Investment managers also have a disadvantage compared to potential capital sources that want to use disclosure regulations under Articles 8 and 9 of SFDR as "labels" for investment purposes. These must be carefully weighed against the risks of misinterpretation of data and accusations of greenwashing.

INREV would like to see a more thorough assessment of the implementation of SFDR, specifically looking at opportunities to improve the usefulness of SFDR through clear definitions and more relevant measurement methods and labels applicable to unlisted real estate products. Guidelines for the names of funds using ESG or sustainability-related terms could then be based on this more comprehensive assessment.

As an example, INREV cites the rules for funds focused on the transition from unsustainable to sustainable real estate assets. One of the main challenges in Europe in terms of climate mitigation is the inadequate speed of sustainable renovation (assessed at 1% per year). To reduce emissions by at least 55%, the European renovation wave focuses on renovating 35 million buildings.

It is crucial that SFDR supports this initiative. An investment strategy that focuses on this topic would be a value-add fund that acquires "non-sustainable" buildings and renovates them to "sustainable" within a period of approximately 3-5 years (depending on factors such as the expiry date of the lease, the design and construction program, planning and supply chain limitations, etc.). After being repositioned, the assets are sold to core funds. Such a portfolio would therefore contain mainly unsustainable assets by definition (awaiting or undergoing renovation). The requirement to hold 50% sustainable investments at all times to give such a fund a name that describes its true purpose (sustainable renovation/climate impact) would make it impossible. Therefore, the proposed rule could have a paralyzing effect on capital looking for investments in real estate to address climate change.

Click here for INREV's response to the European Securities and Markets (ESMA) consultation.