ESG regulation tightens in Europe

The EU Taxonomy contains a classification system that allows investors and companies to identify which investments are and are not sustainable, and on which environmental goals they have an impact. The EU Taxonomy, part of the broader European agenda around making the economy more sustainable, aims to guide more private capital towards sustainable goals and thus contribute, among other things, to achieving the goals of the Paris climate agreement. For the financial sector and companies, besides the EU Taxonomy, the Sustainable Finance Disclosure Regulation (SFDR) and the Corporate Sustainability Reporting Directive (CSRD) are also relevant. For many (property) organisations at least, this means adjusting policies, as well as setting up processes and systems for data collection and reporting.

Regulators, such as the AFM in the Netherlands, are tightening their supervision when it comes to (real estate) investment products promoted as 'ESG-proof'.

SFDR: Mandatory adverse sustainability indicators

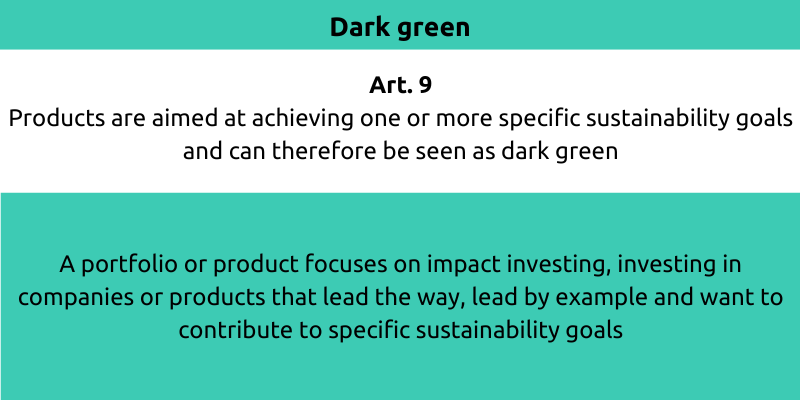

Those looking to benefit from the ever-increasing flood of capital towards sustainable real estate must provide hard evidence. From the end of 2022, the so-called SFDR regulation from Europe has been further tightened and must be reported at fund and product level (the individual asset) if a fund is to be recorded as 'dark green'.

ESG Ambitions

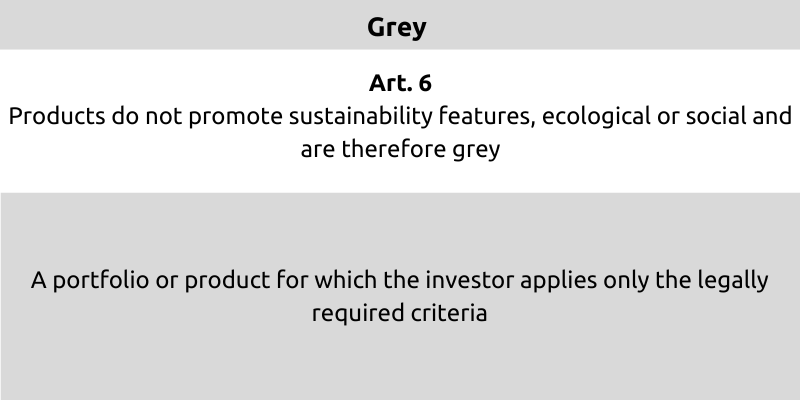

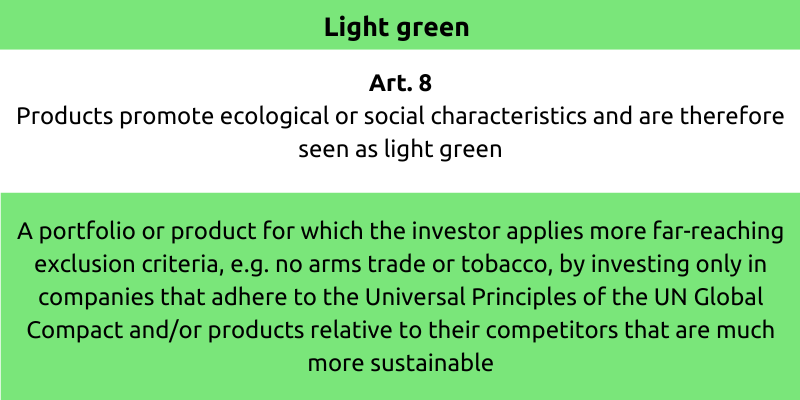

SFDR focuses on ESG disclosures in the financial sector and aims to harmonise them. Depending on sustainability or ESG ambitions, it distinguishes between so-called grey, light green and dark green products.