Expo Real: Strong growth of Article-9 ESG funds

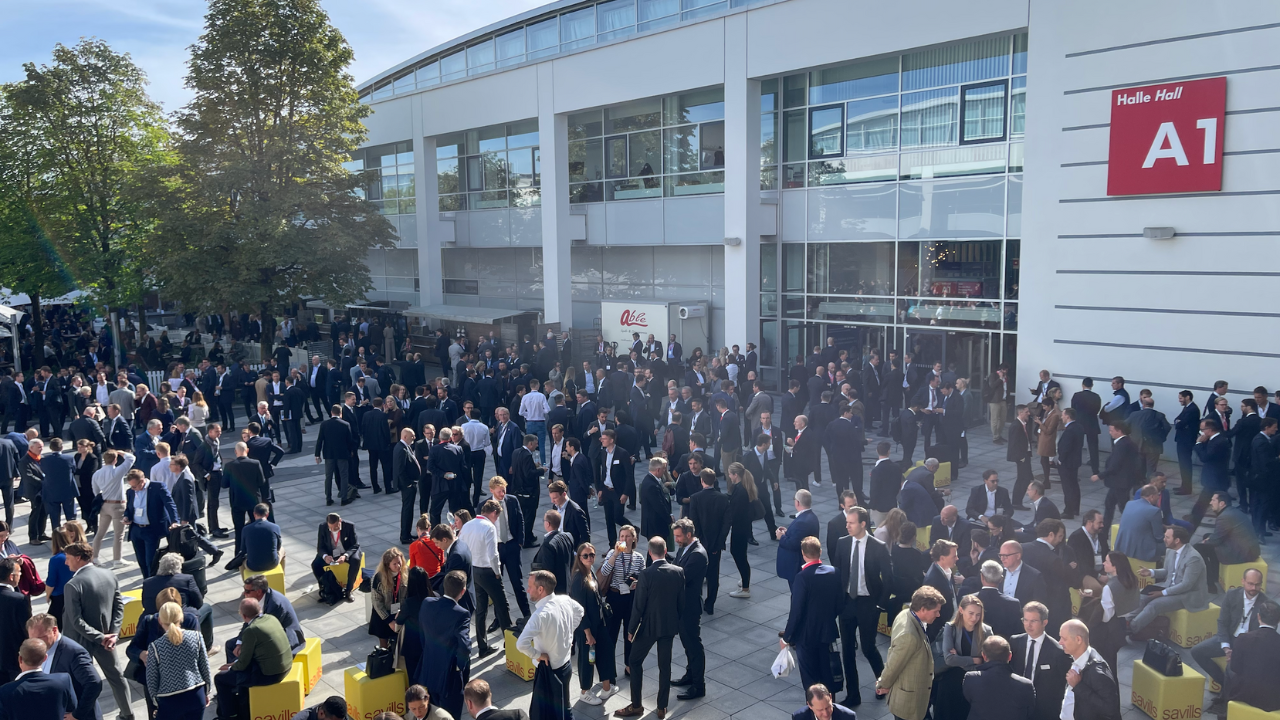

Expo Real 2022 is all about Environmental Social Governance (ESG). An unprecedented number of meetings have ESG as their topic. Also, more and more asset managers are working on so-called Article-9 funds that have to score very high in terms of ESG targets and prove it hard. This applies to all types of property, whether offices, retail, industrial or residential.

Measuring ESG performance is a very hot topic at Expo. And this is not just about measuring property energy performance (the 'E'), but also measuring performance around health and well-being (the 'S').

At a forum discussion titled Impact Investing, ESG & Sustainable Investment, organised by Real Asset Live, speakers Vincent Bryant (Deepki), Maximilian Riede (Swiss Life), Jens Böhnlein (Commerz Real), Sebastian Kreutel (PWC), Jan Petr (Schroders Capital) and Paul Wessels (Blue Module) agreed that the fastest beats in ESG over the next two years can be made with the E (energy, greenhouse gas emissions). With energy prices rising rapidly, investing in 'E' - and measuring it - is a no-brainer. At the same time, speakers at the forum concluded that parties that can make strokes with improving 'S' (health, wellbeing) in their portfolios will prove to be the winners.

There was also much talk on the show floor about the rise of so-called Article-9 funds, which are currently growing like crazy. According to the Sustainable Finance Disclosure Regulation (SFDR), these are property investments that make an effective contribution to an environmental and/or social objective, do not harm other environmental and/or social objectives and where the investee company meets minimum good governance standards. Providers of Article 9 products should clarify how the (underlying) investments fall within the definition of a sustainable investment as referred to in the SFDR. Last but not least, an Article 9 product must have a concrete and measurable sustainable objective.