"ESG-compliant real estate hotter than ever, greenwashing and lack of evidence becoming a growing problem."

ESG and sustainability are becoming increasingly important factors for the growing interest of investors in tangible assets such as real estate and infrastructure. The big question is how: investors see greenwashing as a major risk, followed by high valuation and difficulties in measuring actual impact.

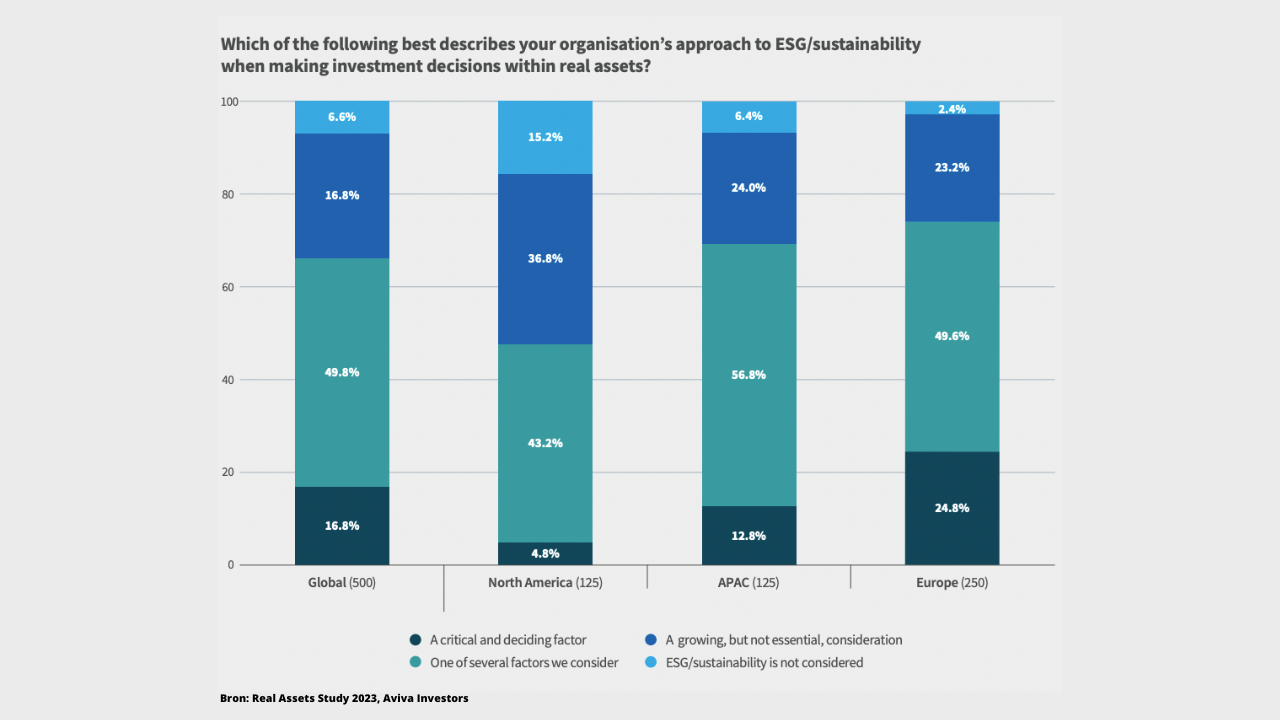

Nearly all investors now take ESG factors into consideration when making decisions about investments in tangible assets, according to a recent survey by Aviva Investors.

The survey, called Real Asset Study 2023, surveyed 500 institutional investors in Europe, North America, and Asia, who collectively manage assets worth $3.5 trillion. The survey showed that nearly two-thirds of investors plan to increase their allocation in tangible assets, such as real estate, in the next two years, compared to just 12% who expect to decrease their exposure. Sustainability factors have become an increasingly important driver, with 28% of respondents citing positive ESG impact as the primary reason for allocation to tangible assets, significantly higher than just 17% three years earlier.

The report concluded that there has been a "shift in attitude towards ESG and sustainable investment approaches," also applicable to tangible assets. Nearly 93% of investors consider ESG factors when making decisions about investments in tangible assets, with 17% considering it as "critical and decisive" factors. ESG factors also played a prominent role in the main reasons for investors to reject or sell real assets, with a lack of clarity over ESG credentials or impact reported by 38% of respondents and concerns about the level of performance or transparency on ESG grounds by 32%. Over a quarter of respondents reported plans to increase their allocations to tangible assets, with renewable infrastructure as the most popular category.

The report investigated the main reasons why investors decide to increase their allocation to sustainable 'real assets'. The main reasons are alignment with corporate values, risk management, and growing evidence that sustainable investments perform better financially. The survey also revealed the biggest risks for investments in tangible assets such as real estate, with greenwashing being the biggest risk. Investment strategies that combine both financial return and positive ESG outcomes are the most popular. Investments focused on the energy transition are seen as a "sweet spot" with top positions in both factors. The Chief Investment Officer of Aviva Investors, Daniel McHugh, notes that real assets now play a meaningful role in overall portfolios with different risks and inflation protection. The demand for these investments is also driven by the ability to evaluate the positive impact of these investments.