ESG regulation European property funds tightened further

Those who want to benefit from the ever-increasing flood of capital towards sustainable real estate must provide hard evidence. From the end of this year, so-called SFDR regulations from Europe will be further tightened and must be reported at fund and product level (the individual asset) if a fund is to be recorded as 'dark green'.

Despite the 'perfect storm' now sweeping across the economy, ESG regulation in the EU, the UK and the Asia-Pacific region is gaining momentum, with numerous proposals for corporate disclosure of ESG information already in force or set to come into force this year or next.

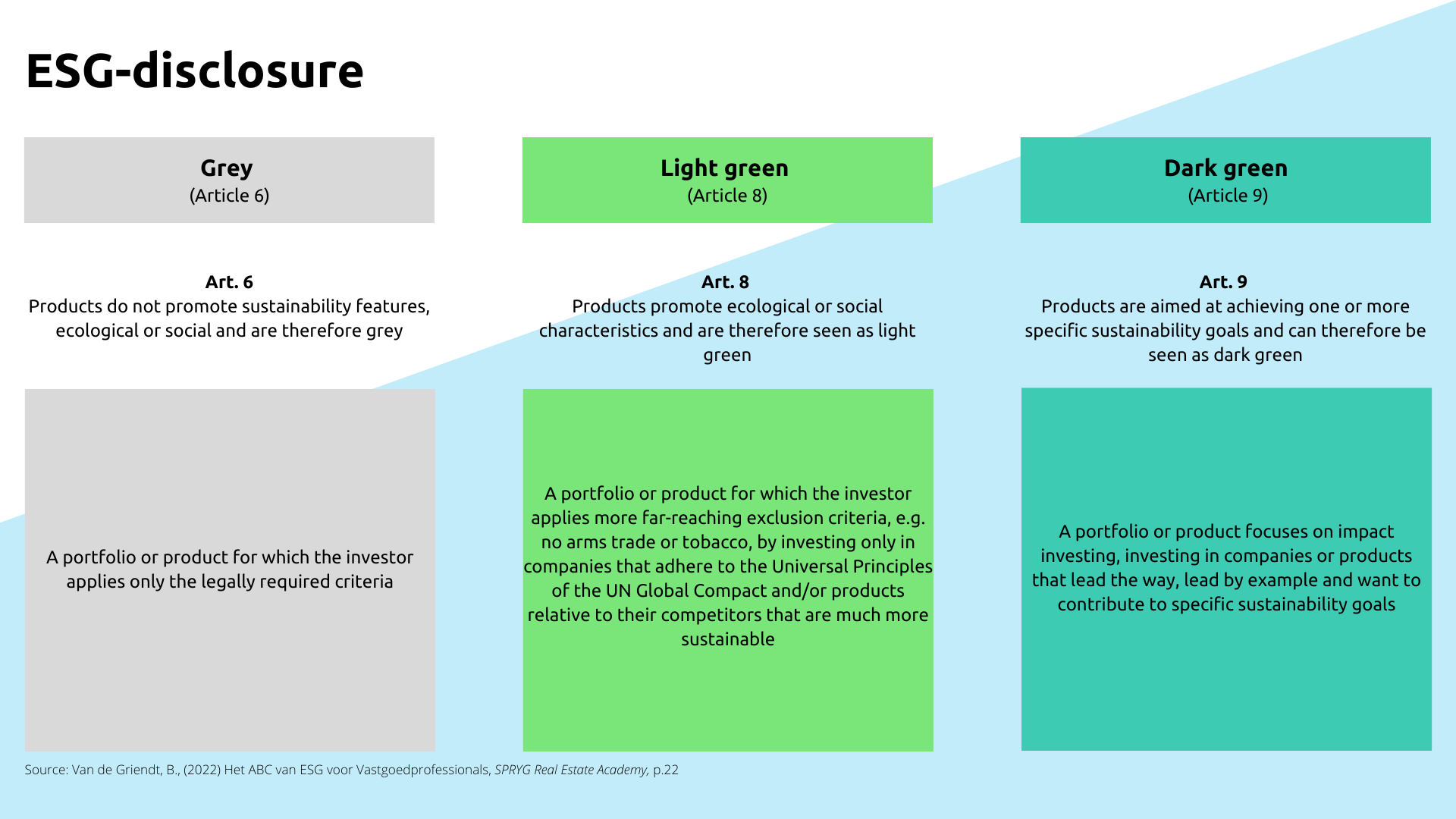

This is very evident in Europe. As part of the European Sustainable Finance Action Plan, financial market participants offering financial products in the European Union must comply with the Sustainable Finance Disclosure Regulation (SFDR), which was phased in from 10 March 2021. The aim is to increase market transparency and channel capital to more sustainable businesses.

The most challenging aspect of the SFDR is the new Principal Adverse Impacts (or PAI) regulation. Principle Adverse Impact indicators are a set of mandatory indicators underpinned by hard data designed to show investors how certain investments pose sustainability risks. Under these new rules, fund managers, financial advisers and other financial institutions will have to collect ESG data and disclose all sustainability risks related to their investments and financial products. This also affects the real estate sector to a large extent.

The reporting requirements cover the entity and product levels, with the information on entities consisting of a company's policies and decision-making on sustainability risks. The financial products themselves include (non-exhaustively): investment and mutual funds, insurance-based investment products, retail and occupational pensions, and insurance and investment advice.

From beginning of next year, financial participants that take into account PAIs on sustainability factors will be required to disclose in their pre-contractual information documents how each of their financial products takes such securities into account. Financial vehicles that do not take into account negative impacts in terms of ESG must explain the reasons for that decision in their pre-contractual information documents.

The product-level information must be included in a company's relevant pre-contractual information and periodic reports. The reporting requirements are intended to increase transparency on ESG data and thus protect the end investor. The presence of the SFDR means that funds cannot simply be described as sustainable investments; companies will have to demonstrate that sustainability and companies will have to explain specifically how they achieve their ESG objectives.

A total of 14 key indicators (9 indicators related to the environment, and 5 related to social factors) are considered mandatory for a proper assessment of negative sustainability impacts on a range of ESG factors. In terms of climate, these include hard evidence around CO2 emissions and energy use - highly relevant to the real estate sector. In terms of social indicators, reference is made to the UN Global Compact Principles and OECD Guidlines. These cover human and labour rights, anti-corruption and also living environment. The latter category is very relevant to real estate: after all, we spend 90% of our time between four walls. Important issues such as air quality, water, food, light and comfort then come into play.

During the last property fair Expo Real in Munich, there was much talk about the rise of so-called Article-9 funds, which are currently growing like crazy. According to the Sustainable Finance Disclosure Regulation (SFDR), these are real estate investments that make an effective contribution to an environmental and/or social objective, do not harm other environmental and/or social objectives and where the investee company meets minimum good governance standards. Providers of Article 9 products should clarify how the (underlying) investments fall within the definition of a sustainable investment as referred to in the SFDR. Last but not least, an Article 9 product must have a concrete and measurable sustainable objective.