ING: Sustainability becomes the dominant driver of the office market as demand for space declines

Office occupiers are more critical than in the past on three fronts: location, the amount of space, and the energy efficiency of office buildings.

This is stated by ING Research in its latest Real Estate Sector Update. Rents for “net zero” offices are relatively higher than those for offices that do not yet comply with climate agreements, and offices with an energy label C or higher are, on average, sold at relatively higher prices than those with poorer energy ratings. Looking ahead, ING expects the importance of sustainability in the office market to increase further due to anticipated stricter climate policies. As a result, investors are increasingly factoring expected decarbonisation and sustainability costs into their acquisition decisions.

The trend identified by ING means that pressure on office owners is increasing to actually—and importantly, demonstrably—improve the ESG performance of their buildings.

Meanwhile, competition for office space continues to intensify, as illustrated by an analysis from CBRE. Large companies planning to shed office space indicate that they expect to take up, on average, 10% to 20% less space. However, large companies that have recently relocated leave behind only about 7.5% of their office space on average.

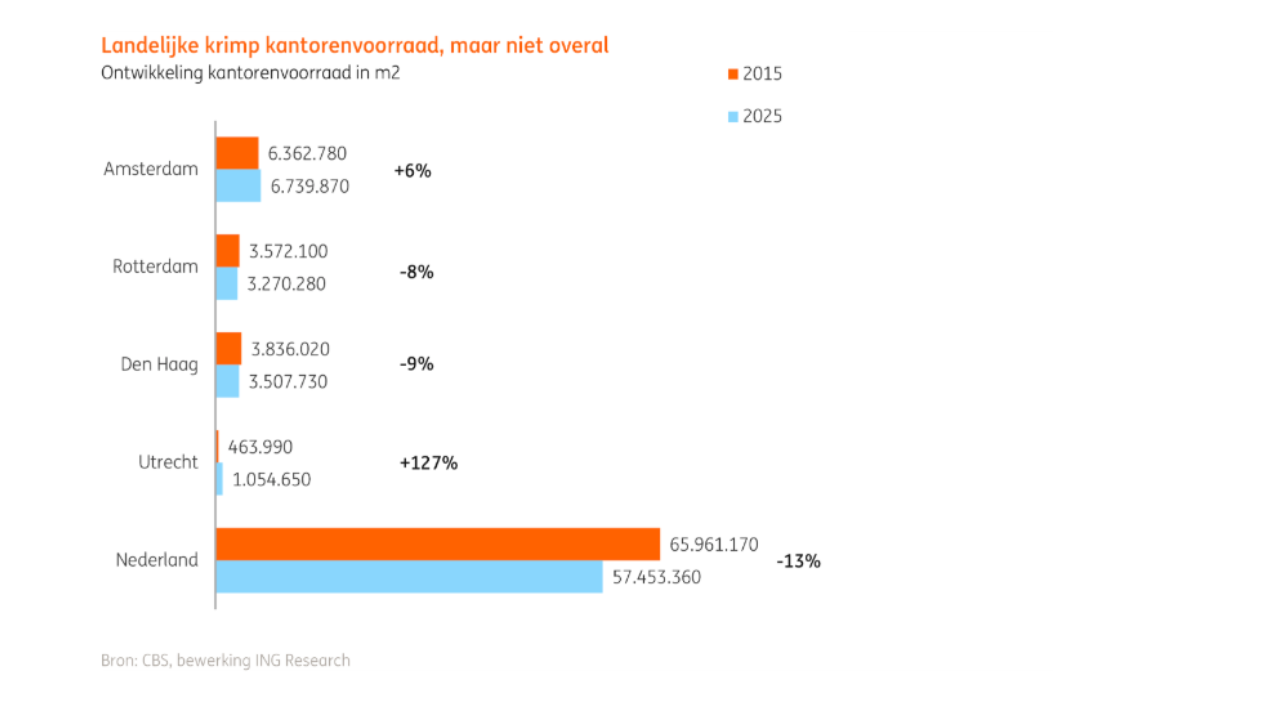

This is reflected in market take-up figures. Last week, researcher Rudolf Bak reported that take-up of office space on the open market in 2025 in The Netherlands amounted to approximately 730,000 square metres. According to data from Bak Property Research, this is the lowest level of office take-up since 1986.

Blue Module software helps office building owners with holistic optimisation (starting with the “S”), reporting towards tenants, and certification. Together with our partners, we also provide organisational advisory services on how these optimisations can be effectively embedded in management and operations.